TIFs, Debt, and Meadowbrook

The topic of city debt concerning the Meadowbrook redevelopment has come up lately, specifically whether the city owes debt related to bonds issued to finance the purchase and public development of the Meadowbrook land.

The short answer is no. The city does not have an outstanding debt to pay back for Meadowbrook or Meadowbrook bonds.

The long answer continues below.

A Successful TIF Project

Not every day, you hear somebody talking about a TIF project being "successful," but Meadowbrook can pretty easily qualify as one. I'm naturally skeptical of TIF, but I must call a spade a spade here. The project aimed to finance a major public amenity by leveraging private mixed-use. On that goal, it handily succeeded. Perhaps I have criticisms about the housing price in Meadowbrook, knowing what we know now, but those weren't (so far as I know) goals of the original project.

From a 30,000-foot level, the development converted an old golf facility into a very large destination park run by Johnson County Parks and Recreation (JCPRD), along with a private, mixed-use development that includes a retirement facility, hotel, apartments, restaurant, homes, and other neat features.

The city of Prairie Village financed the project, starting a TIF district with the assent of the county and school district. TIF, or tax-increment financing, is a tool that's been around for decades.

How TIF Works

TIFs are complicated. If this seems needlessly confusing, you can skip this section.

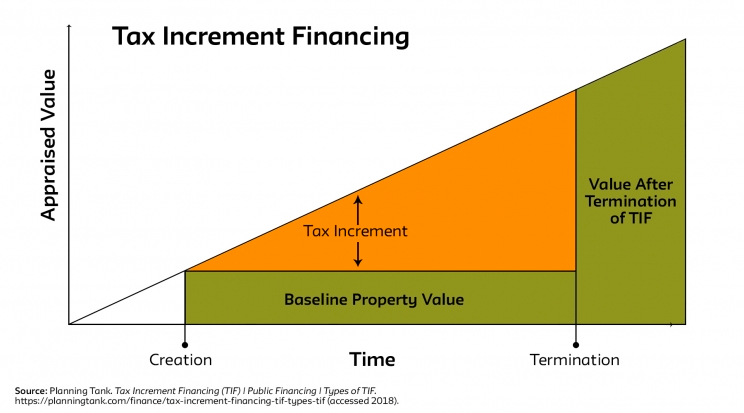

When a TIF district is established, all taxing districts (think city, county, schools [minus some outflow to the state]) agree to tax the district at the baseline property value or the value of the property before any improvements are made commensurate with the TIF district. As improvements are made to the properties in the TIF district, the enhanced property value (or "tax increment") is captured and used to pay for the costs of establishing and developing the TIF district. In Kansas, the approved expenses for a TIF district are outlined here. In the case of Meadowbrook, Prairie Village planned to use the enhanced value to pay down the costs of acquiring the Meadowbrook land and, through JCPRD, develop it into the major destination park it is today. Kansas TIF districts can "live" for 20 years but can be dissolved earlier.

The city issued general obligation TIF bonds in 2016 to pay for the improvements to the TIF district. General obligation bonds are bonds that are backed by the full faith and credit of the city. The plan was that the tax increment (again, see above) would cover the city's bond payments as it increased. The risk for the city was that if the tax increment did not rise high enough, then the city would be on the hook to cover the general obligation bonds. If the developer failed to develop the property, the city could be on the hook for a lot of money.

How Did the Meadowbrook TIF Work Out?

Fortunately, everything worked out incredibly well. The Meadowbrook project has outperformed projections significantly due to the rising cost of housing and the high performance of the properties in the private development portion of the TIF district. On its current track, it will pay down its TIF bonds early.

Meadowbrook overperformed so well that the city could convert its general obligation TIF bonds to special obligation bonds in 2021. I voted yes on this slam dunk restructuring. The bond interest rates were at a low point, and investors in the market were actively courting municipal bonds that brought reliable returns. Meadowbrook was an obvious candidate.

When the city converted these bonds (general obligation (GO) to special obligation (SO)), it essentially "refinanced" the first bond and replaced it with a different type of bond that placed the repayment risk with the new bondholder. The process looked like this:

- The new bondholder repaid the city's general obligation debt

- The new bondholder began receiving Meadowbrook TIF payments to repay the money it paid the city with an interest rate. The interest rate is lower than what the city paid on its general obligation (GO) bond.

- The new bondholder assumed any risks associated with the tax increment falling short of repayment. If the district did not generate enough money to make bond payments, the risk falls to the bondholder, not the city. The city is off the hook.

What is the Upshot of this Bond Stuff?

All municipalities have a "borrowing limit," as people do. We generally refer to this as our "bonding capacity." Debt that impacts our borrowing limit or our bond capacity falls in the general obligation bond category. Special obligation bonds do not impact our debt load. The city's involvement with SO bonds is largely mechanical, taking money in and moving it between accounts. SO bond money isn't considered part of the city's operating budget, but it is accounted for during audits as relevant "debts" (in a legal sense) of the city. Still, they're not debts in any way normal people think about them. The city isn't obligated to repay debts that don't impact our bonding capacity or credit rating.

So does the city owe a debt for Meadowbrook?

While financial and auditing terminologies might call it a "debt," it's not something we pay interest on. It's not something we are liable to pay back. There is no analogous type of household debt, and folks thinking that SO bonds are the same thing as a kind of household debt are perhaps misinformed or are potentially equivocating on the issue to make the city sound like it's in a worse-off position than it is.

Here are the critical pieces to keep in mind:

- The city and other taxing districts still collect property taxes from the district as if it were still the old golf course before its redevelopment.

- The new property value is paying down bonds related to redevelopment and establishing the possibility of that new property value.

- All risk is held by a third party that is not the city.

- When the TIF district ends, it will be a major tax windfall for the city, the county, and Shawnee Mission Schools.

- We got a sweet park out of it.

So no. We don't owe any debts on Meadowbrook. Not in the sense that you and I think about our car payment, credit card debt, mortgage, or anything else. It's a successful project, and the council members involved and former Mayor Wassmer are to be commended for taking the risk and working hard to make it possible.

Need a Little Extra Proof on the Debt Part?

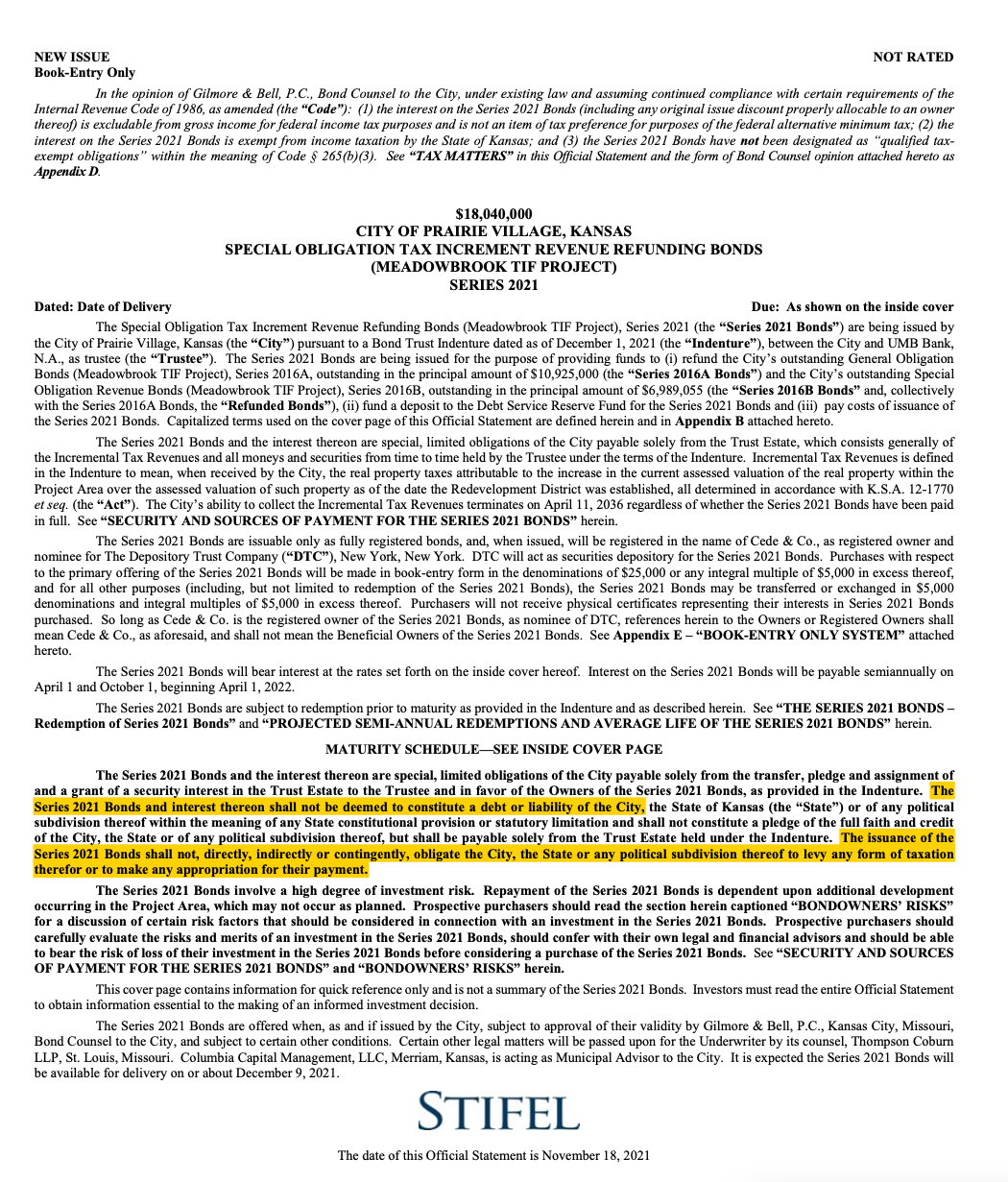

Maybe you are still a little unsure?

Feel free to read the highlighted portion of the special obligation bond language from when we restructured the GO bonds into SO bonds.

See you on Mount Meadowbrook, friends.